Corporate Finance

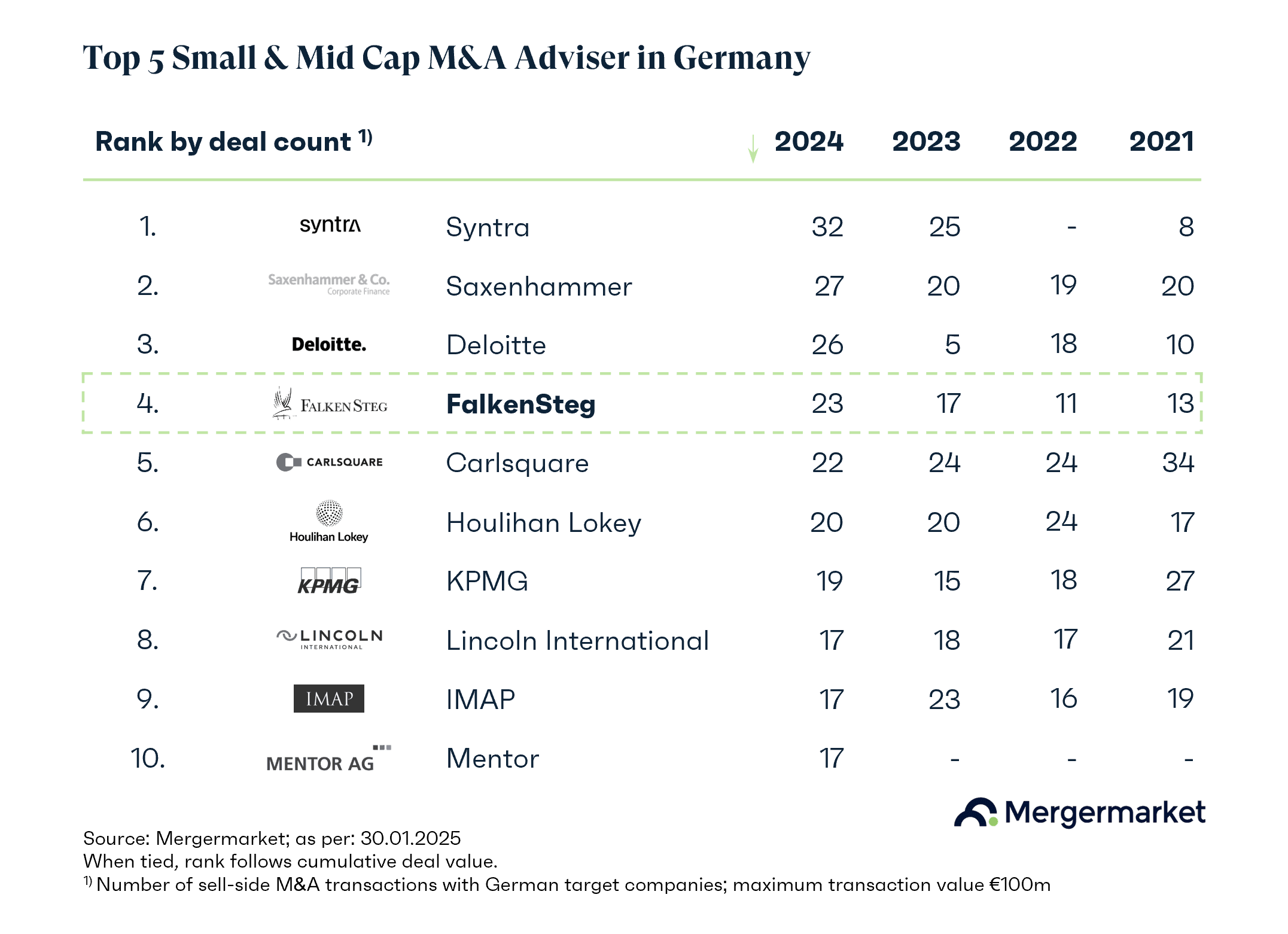

FalkenSteg is one of the leading advisory boutiques for M&A transactions in the German small and mid cap environment.

We successfully implement M&A transactions on the sell and buy side for our medium-sized clients in a wide range of industries.

FalkenSteg supports you with an experienced team of M&A specialists in all phases of your sales process - from process preparation, market approach and due diligence to contract negotiations and the conclusion of the contract.

Specifically, we support entrepreneurs and investment companies in the context of succession solutions and strategic portfolio adjustments.

We approach the process from the desired end result and thus anticipate potential value drivers and deal breakers at an early stage. Our clients benefit from our resilient network of decision-makers consisting of international strategists and financial investors.

FalkenSteg advises you on all relevant issues relating to company acquisitions. Our clients include international industrial and service companies from Germany and abroad, whom we support in the acquisition of shareholdings in Germany.

You can rely on our many years of transaction experience in all sub-processes and for all purchase occasions, from the development of the strategy factors relevant to the purchase to the moderation and management of the negotiation process through to the signing of the contract.

We generally distinguish between the following initial situations for acquisitions:

Regardless of the initial situation, strategic value creation along an efficient and results-oriented acquisition process is the focus of our buy-side service portfolio:

Companies can realize significant value potential through the targeted spin-off of business activities outside their strategic core business. This requires active portfolio management to identify suitable disposal packages as part of a strategic realignment.

FalkenSteg provides companies with comprehensive support throughout the complex carve-out process, from preparation to transaction support for the business unit(s) to be sold:

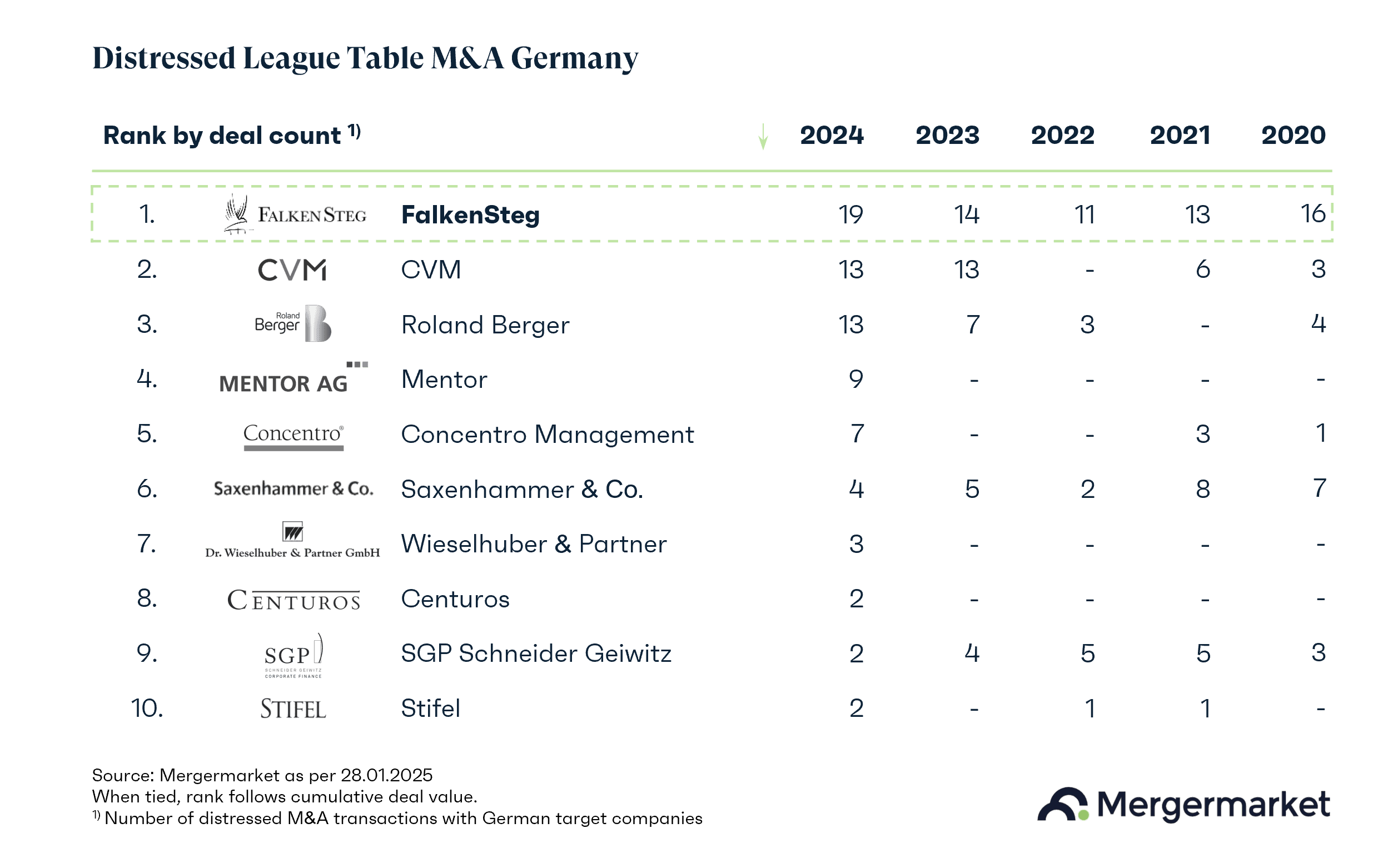

As the market leader for distressed M&A transactions in Germany, we support companies and their shareholders in the sale of companies or parts of companies in crisis, as well as insolvency administrators and creditor representatives in the implementation of structured M&A processes to market insolvent companies. In addition, we advise investment companies on strategic divestments of low-return portfolio companies.

In insolvency proceedings, we also structure recapitalizations as part of insolvency plan solutions, often in the context of self-administration, in addition to asset deals. In order to maximize creditor interests, both strands of action can also be implemented in parallel and with an open outcome as a so-called dual track process.