Jochen Wierz

Partner

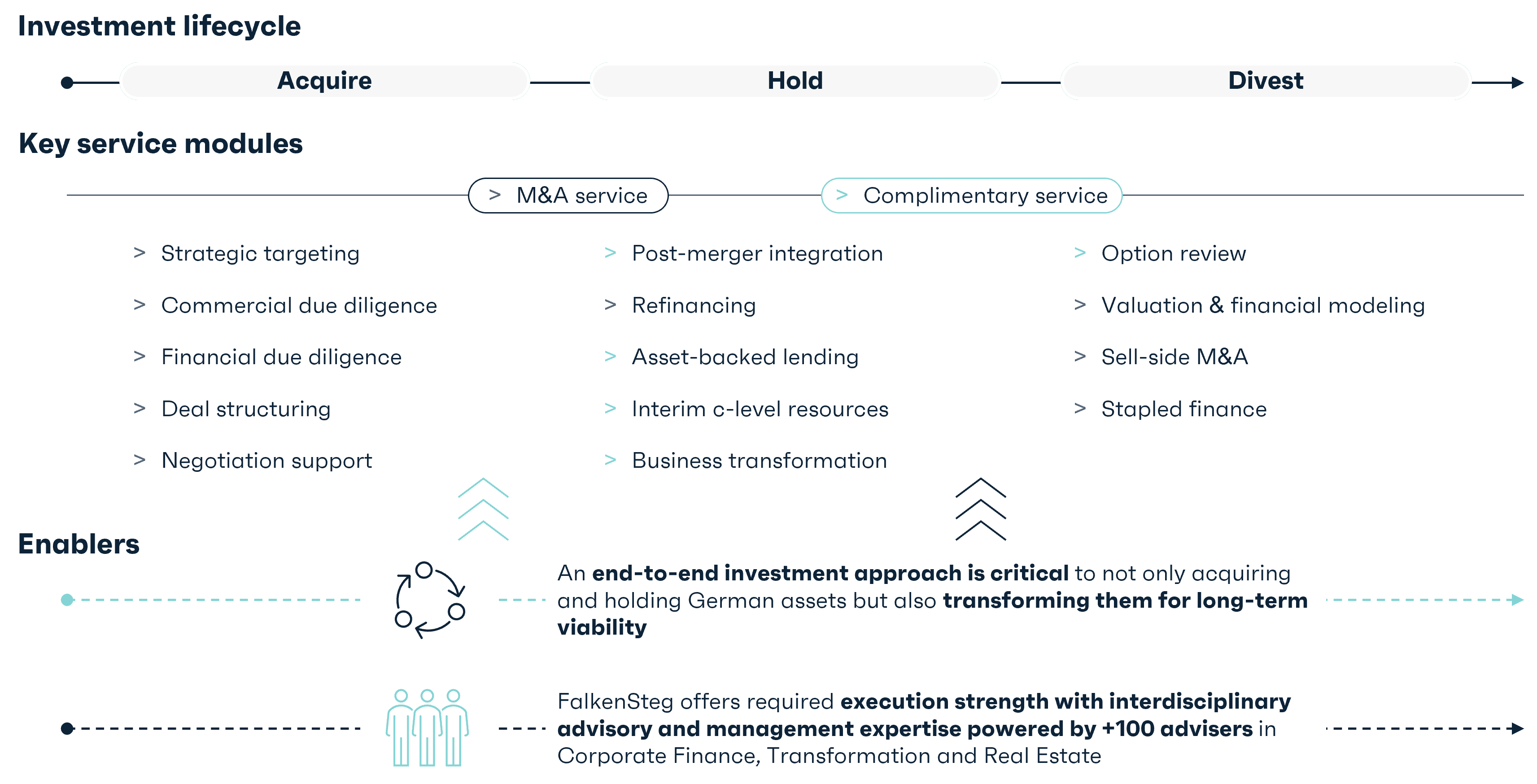

Advising investors and entrepreneurs from outside of Europe with a complementary service portfolio that holistically addresses pressing transformation, growth and financing challenges.

Institutional execution capabilities based on strong organizational advisory expertise in Corporate Finance, Transformation and Real Estate for investment, divestment and transformation projects in Germany

German „Mittelstand“

Private equity

Restructuring practitioners

Financing partners

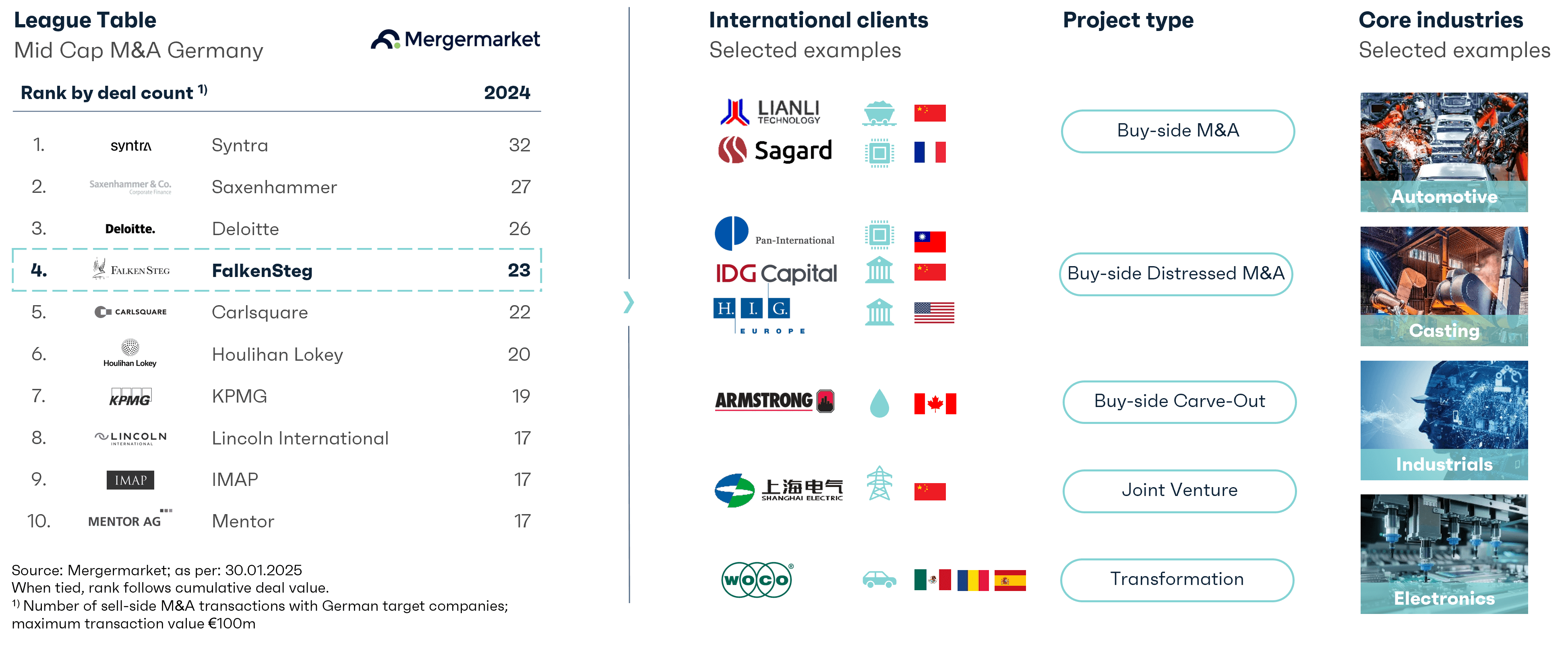

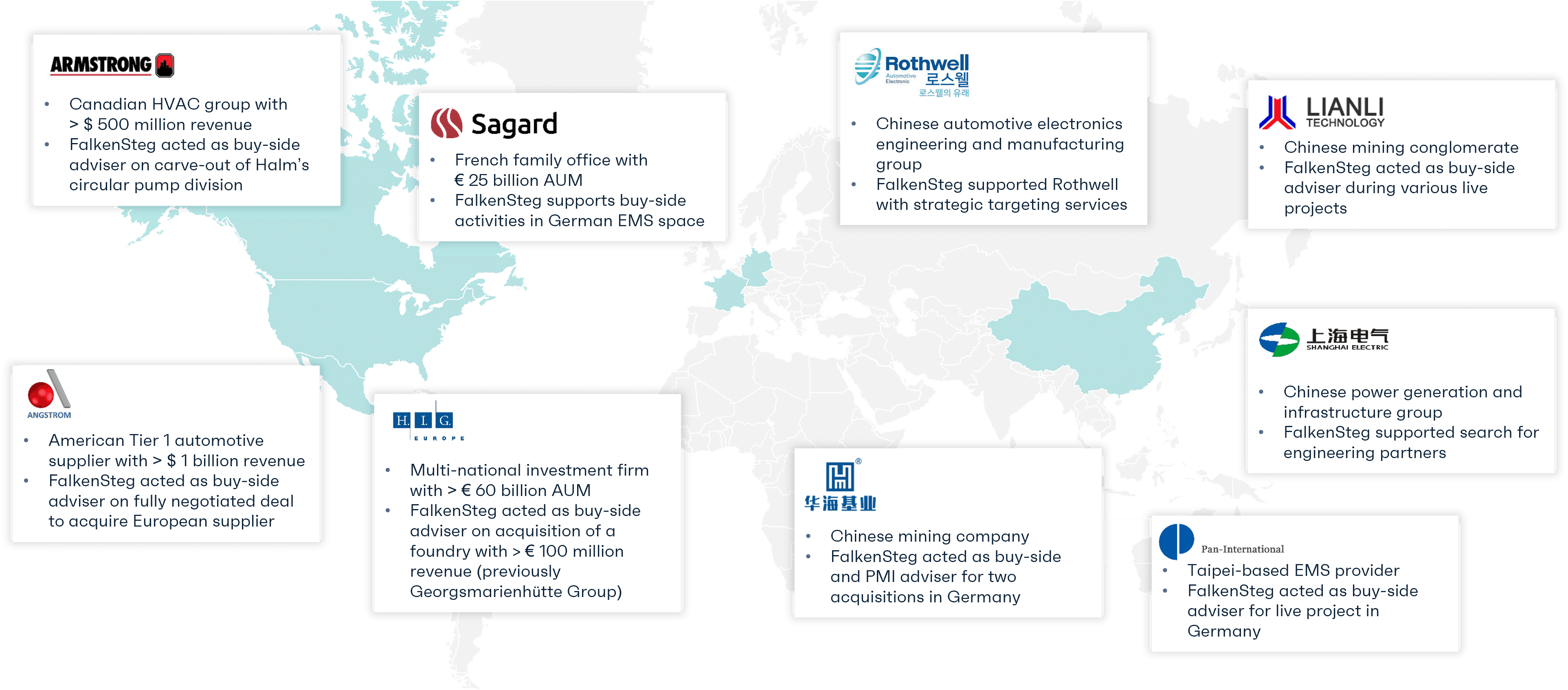

Our M&A professionals are committed to helping Chinese enterprises become genuine players in German-speaking markets. Our services are uniquely tailored to each engagement in order to suit your corporate strategy and targeting requirements.

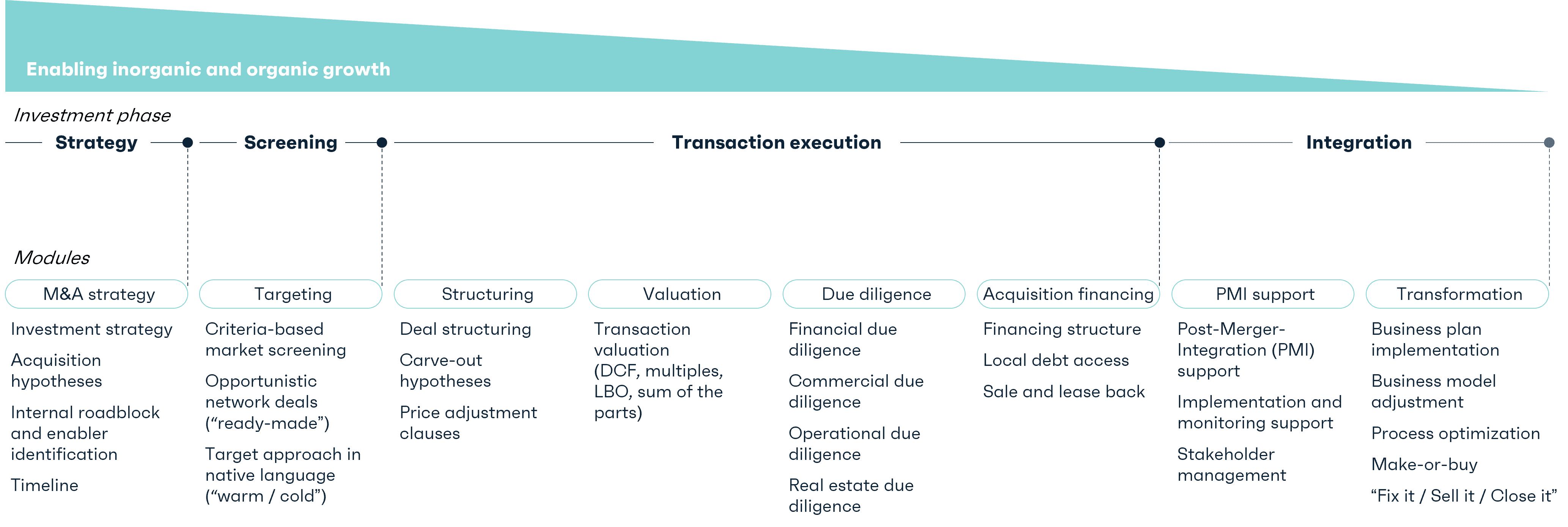

We deliver clear-cut value across all transaction stages from the early planning through execution and due diligence to legal advice and post-merger integration. As a result, we empower our international clients to successfully navigate through German-speaking markets and their neighboring countries.

As M&A transactions are multi-layered and highly complex processes, having a partner who will navigate through turbulences can be the difference between failure and success, especially in the context of cross-border transactions. We pride ourselves on leading our clients to success in their growth endeavors.