Restructuring

Achieving the turnaround together

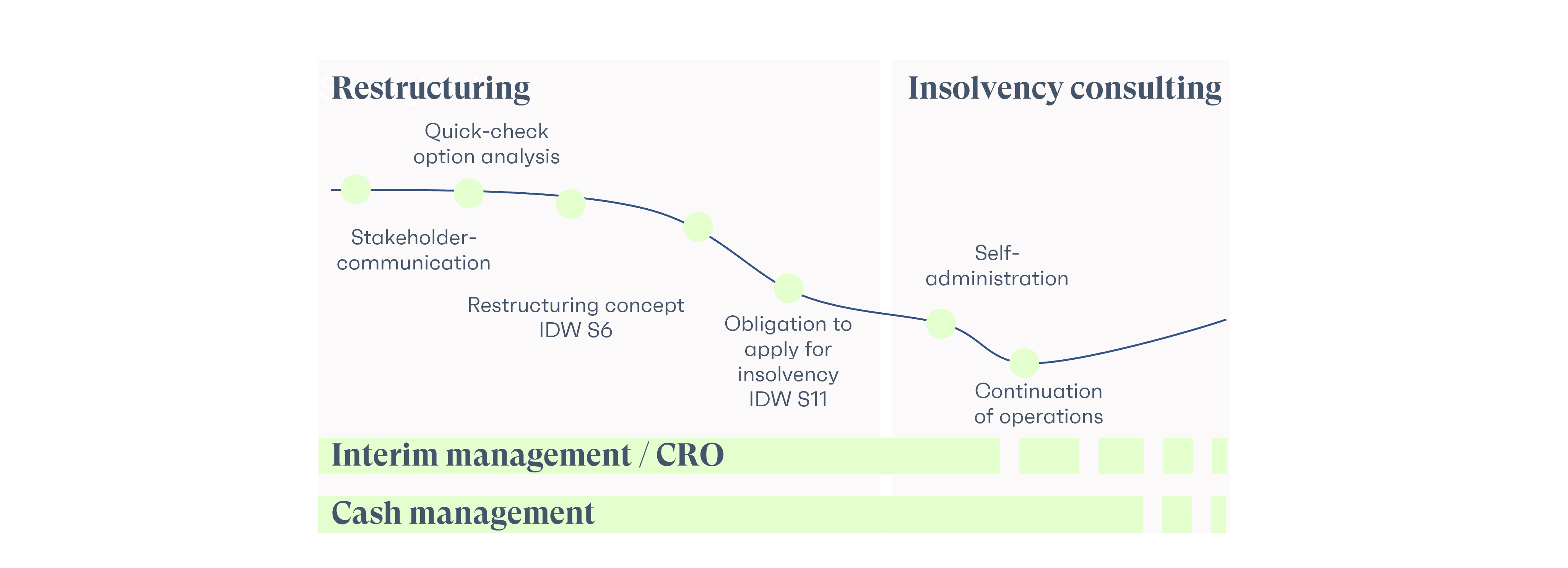

A holistic approach to restructuring

With FalkenSteg, you have a reliable partner at your side who offers you 360° services and supports you in every step of the restructuring process.

No matter what situation your company is currently in, FalkenSteg will support you in any special situation and help you to help yourself and to shape the economic turnaround together.

Restructuring projects

per year

0

Continuation solutions achieved

0

Professional experience

in years

0