Corporate Finance

Sole Debt Advisor | Refinancing syndicated loan

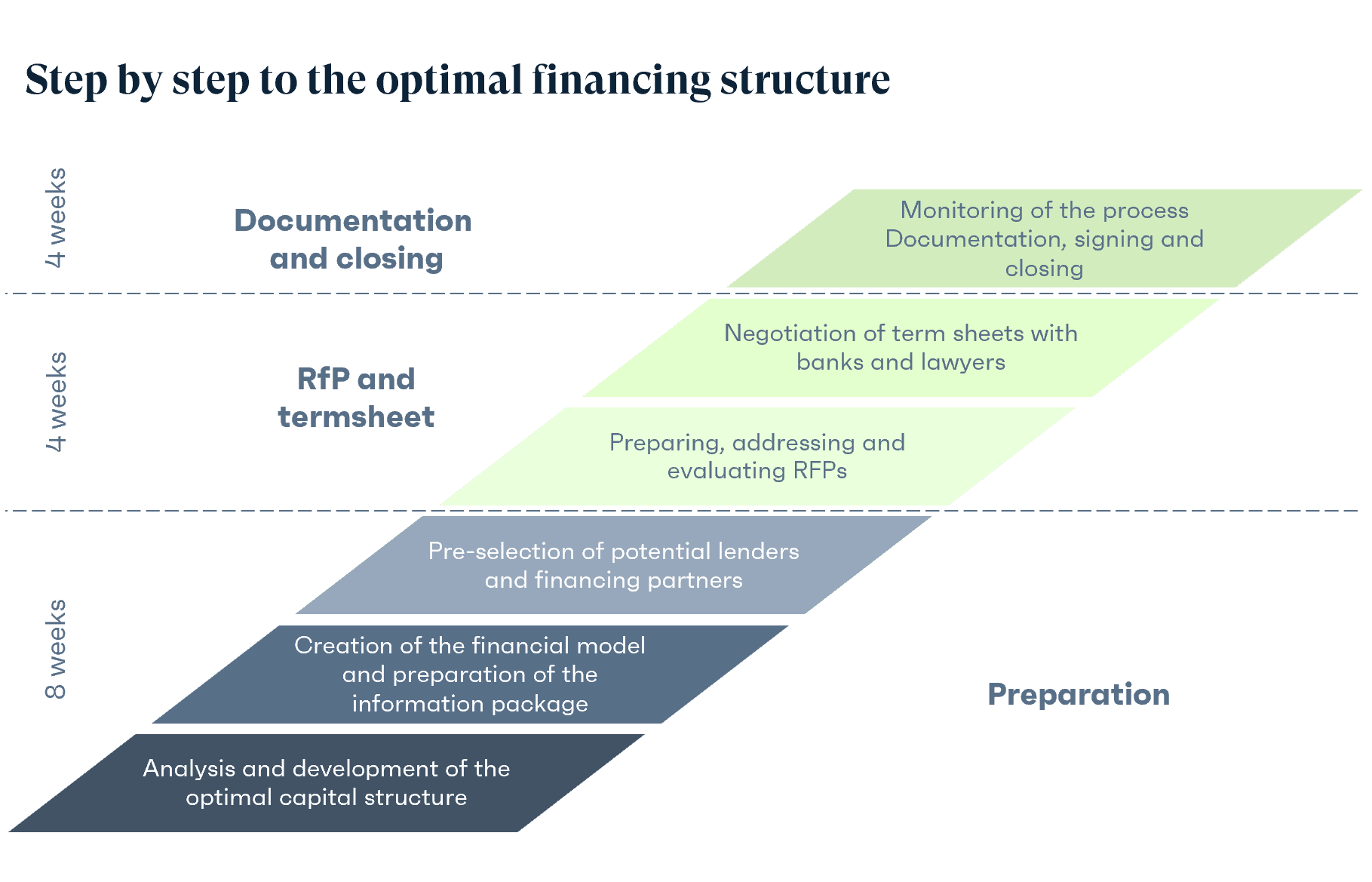

FalkenSteg advises you on the design of your optimal capital structure. In doing so, we take into account the current macroeconomic environment, your individual situation and that of your stakeholders.

Both family businesses and corporate groups rely on our expertise. Our focus is on loan volumes between 50 million euros and 750 million euros.